The difference between absorption costing and variable costing can have a significant impact on manufacturing decision-making. For example, absorption costing typically shows a higher profit margin than variable costing when production volume is high and a lower profit margin when production volume is low. Additionally, it is not helpful for analysis designed to improve operational and financial efficiency or for comparing product lines. The allocation of fixed overhead to units produced means net income is lower than under variable costing, which treats fixed overhead solely as a period cost. However, absorption costing adheres to GAAP and provides a fuller valuation of inventory.

How does Absorption Costing vs. Variable Costing affect manufacturing decision-making?

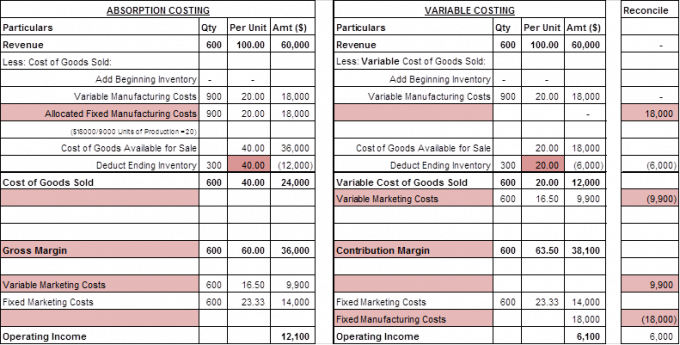

Finally, remember that the difference between theabsorption costing and variable costing methods is solely in thetreatment of fixed manufacturing overhead costs and incomestatement presentation. Regarding selling andadministrative expenses, the only difference is their placement onthe income statement and the segregation of variable and fixedselling and administrative expenses. Variable selling andadministrative expenses are not part of product cost under eithermethod. Variable costing only includes the product costs that vary with output, which typically include direct material, direct labor, and variable manufacturing overhead. Fixed manufacturing overhead is still expensed on the income statement, but it is treated as a period cost charged against revenue for each period. It does not include a portion of fixed overhead costs that remains in inventory and is not expensed, as in absorption costing.

Skewed Profit and Loss

Absorption costing also provides a more accurate accounting of net profitability, especially when a company doesn’t sell all of its products in the same accounting period in which they are manufactured. Every expense is allocated to products manufactured whether or not they are sold. Both product and period costs are essential for making informed management decisions. Managers can make decisions to improve their profitability by understanding both types of costs. To determine period costs, you need to know the total expenses incurred during the period.

Accounting Jobs of the Future: How Staffing Agencies Can Help Land Them

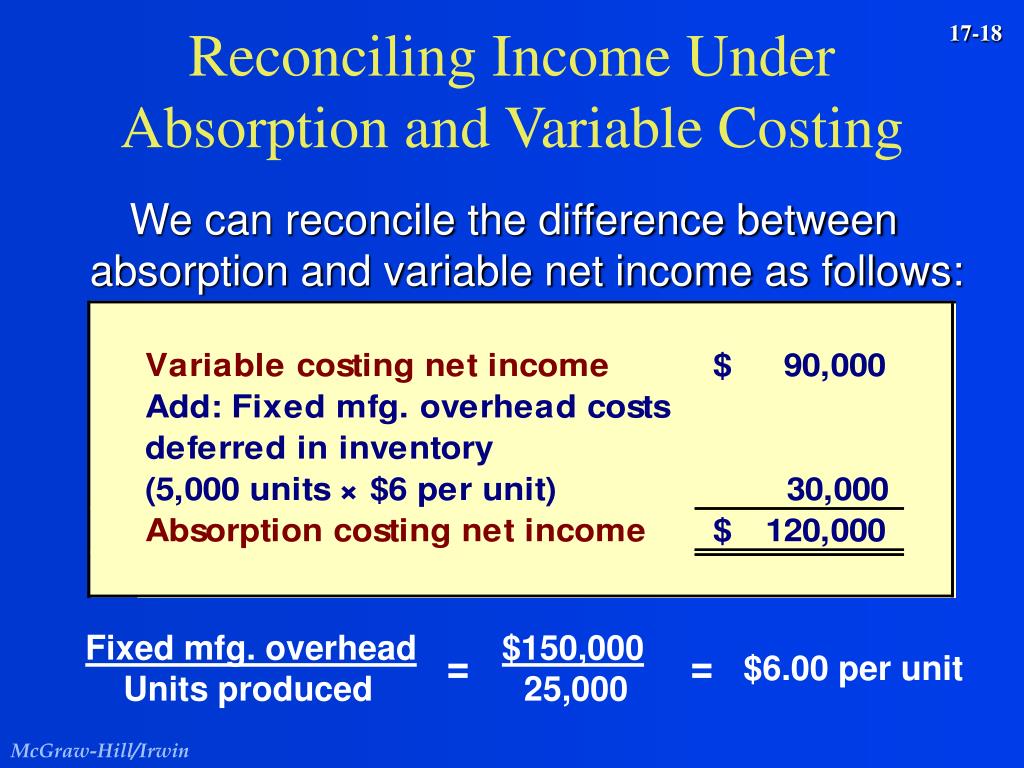

Additionally, fixed overhead is $15,000 per year, and fixed sales and administrative expenses are $21,000 per year. The choice between absorption costing and variable costing can also have implications for profitability analysis. Since absorption costing includes fixed manufacturing overhead costs in the cost of each unit produced, it tends to result in higher reported profits when sales volume exceeds production volume. This is because fixed manufacturing overhead costs allocated to inventory are released as expenses when the goods are sold, increasing the profit margin. The difference between the absorption and variable costing methods centers on the treatment of fixed manufacturing overhead costs.

Further, when inventory levels fluctuate, the periodic income will differ between the two methods. Absorption costing is a method of costing that includes all manufacturing costs, both fixed and variable, in the cost of a product. Absorption costing is used to determine the cost of goods sold and ending inventory balances on the income statement and balance sheet, respectively. It is also used to calculate the profit margin on each unit of product and to determine the selling price of the product. In this example, if 5,000 units were produced and total fixed overhead costs were $100,000, the predetermined overhead rate would be $20 per unit ($100,000/5,000 units).

By understanding how these costs affect the company’s bottom line, management can make better strategic decisions about allocating resources and improving profitability. For example, if a company is spending a lot on marketing but not seeing a corresponding increase in sales, management may reevaluate its marketing strategy. To calculate the variable cost per unit, divide the total cost by the number of units produced. For example, if the total variable cost is $100 and 100 units are produced, the variable cost per unit would be $1.

- Absorption costing generally provides a more accurate picture of the true costs of production, while variable costing is typically more straightforward to implement.

- As a result, the company may conclude that they are better off building cars at a “loss” to avoid an even “larger loss” that would result if production ceased.

- A company has to pay its office rent and utility bills every month regardless of whether it produces 1,000 products or no products at all, for example.

- Absorption costing allocates a share of all manufacturing costs, including fixed overhead costs, to units produced.

As a result, absorption costing can lead to managers making decisions that are not in the company’s best interests. For example, a manager might decide to increase production even if there is no demand for the product simply because it will increase profit margins. Overall, variable costing is a way of allocating expenses between fixed and variable costs. Businesses often use this method to help manage their finances and decide where to allocate their resources. Examples of standard variable costs include wages, rent, utilities, and materials.

Under absorption costing, the amount of fixed overhead in each unit is $1.20 ($12,000/10,000 units); variable costing does not include any fixed overhead as part of the cost of the product. Figure 6.11 shows the cost to produce the 10,000 units using absorption and variable costing. Figure 8.1.1 shows the cost to produce the 10,000 units using absorption and variable costing. Costing methods play a 2020 online tax software, easily e crucial role in determining how a company allocates and tracks its costs. While both methods aim to calculate the cost of producing goods or services, they differ in their approach to allocating fixed manufacturing overhead costs. In this article, we will explore the attributes of absorption costing and variable costing, highlighting their differences and potential implications for decision-making.

The term “absorption costing” means that the company’s products absorb all the company’s costs. When it comes to measuring the cost of manufacturing processes, several methods can determine the cost of manufactured goods. A downward spiral of product discontinuation decisions can ultimately destroy a business that was otherwise successful. This illustration underscores why a good manager will not rely exclusively on absorption costing data. Variable costing techniques that help identify product contribution margins (as more fully described in the following paragraphs) are essential to guiding the decision process.